News and Updates

Contact

Faculty of Social Science

Social Science Centre

Room 9438

Western University

T. 519-661-2053

F. 519-661-3868

E. social-science@uwo.ca

Assistance to the Poor in the United States: Growing or Falling?

March 14, 2018

Story by Rob Rombouts

How are growing trends toward conservatism changing the levels of assistance to the poor in the United States?

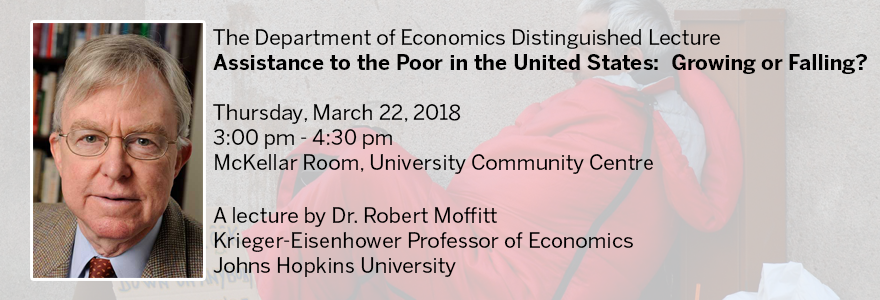

Robert Moffitt is the Krieger-Eisenhower Professor of Economics at Johns Hopkins University. On Thursday, March 22, Moffitt will be the inaugural speaker in the Department of Economics' Distinguished Lecture Series, and will present a talk entitled: “Assistance to the Poor in the United States: Growing or Falling?”

Moffitt studies the US welfare system and how assistance to the poor has evolved. He is particularly interested in poor individuals' ability to sustain themselves with and without government assistance, as well as determining the best types of systems to help the poor.

Moffitt says that over the past 50 years, total assistance to poor has grown dramatically and steadily, such that more assistance is being given out than ever before. There are, however, significant changes in the populations receiving government assistance.

In the past 20 years, welfare and social assistance have increased for seniors, people unable to work due to severe health problems, and full-time workers. Assistance to the last group is provided through an earned income tax credit operated through the tax system.

While assistance to those groups increased, it has decreased for those families who do not have family members who work, and for those individuals who are not employed.

Moffitt believes the prevailing philosophy in the US has led to these changes in the distribution of assistance.

“The philosophy is two-fold,” said Moffitt. “If substantial benefits are provided to those who work, it provides strong incentives to work. So if you work, you get more assistance rather than less. This reverses the traditional approach.”

Moffitt said the other philosophical belief is that “those who work are more deserving in some sort of merit system, and those who deserve more should receive more.”

As an economist, Moffitt is focused on the cost and benefits of different systems. From that perspective, Moffitt said the positives of these changes outweigh the negatives.

For examples, assistance through the earned income tax credit has been shown to increase employment in single mothers in the US by 5-9%.

While these welfare incentives are proving effective for the working poor, the most disadvantaged people in society face multiple barriers, such as physical and mental health issues, living in areas of high crime, facing challenges with stable housing, or living in areas without reliable transportation or childcare. Moffitt said these barriers often keep them from entering the workforce and gaining this assistance.

“If the incentive is purely monetary, if people are told they will get an extra $4,000 if they work a minimum number of hours, many will find work. So there is an incentive,” said Moffitt. “But we have to address problems for those who cannot take advantage, to help them address their issues. We haven’t found the magic bullet for that.”

“As an economist, I’m very much in favour of work-based programs that provide benefits, including monetary ones, for working people,” said Moffitt. “Voters seem to not want to simply give cash to the very poor families that aren’t working. It may be that that’s correct, that what they need instead are specific programs that address their specific needs, and we have to do more on that front.”

Robert Moffitt is a Fellow of the Econometric Society, a Fellow of the Society of Labor Economists, a National Associate of the National Academy of Sciences, a recipient of a MERIT Award from the National Institutes of Health, a recipient of a Guggenheim Fellowship, a Fellow of the American Academy of Arts and Sciences, a past Editor of the American Economic Review, and Past President of the Population Association of America.